Digital Banking

Digital

banking

involves

high

levels

of

process

automation

and

web-based

services

and

may

include

APIs

enabling

cross-institutional

service

composition

to

deliver

banking

products

and

provide

transactions.

It

provides

the

ability

for

users

to

access

financial

data

through

desktop,

mobile

and

ATM services.

Our Digital Banking Facilities are

:

* Mobile banking Application

* UPI Facility

* IMPS through Mobile App

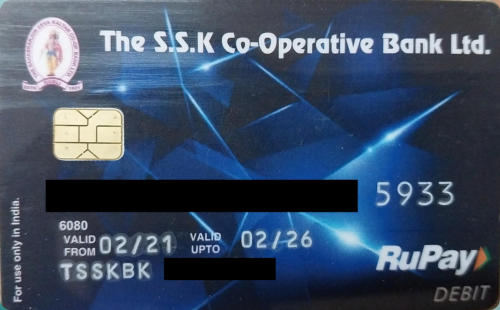

* Debit Card : NFS , POS and Ecom(Online Transaction)

* SMS Banking

* RTGS/NEFT Facility

* E Stamping Facility

Do Cash free Transaction with RUPAY DEBIT CARD

* Go Digital with your account by taking Rupay Debit Card.

* Avoid long queue, draw money all over the country with out any delay.

* Secured transactions, with 128bit encryption.

* Shop at your convenient from online Ecommerce Websites, Local shops, Petrol Bunks etc.,

* Use as many times as you want*.

(* - Conditions apply)

Mobile Banking

* Register for Mobile Banking, Go digital.

* 128 Bit secured Environment

* Login to your account, check your account balance at your finger tip.

* Transfer amount to your loved ones or receive from your loved one.

* Make RTGS/NEFT amount transfer to others and other bank account instantly.

* Do Prepaid Mobile Recharge, DTH Recharge or pay your utility bills at your finger tip.

* Cheque book Request.

* Stop Payment Request.

NEWLY INTRODUCED UPI [UNIFIED PAYMENT INTERFACE ] PAYMENT FROM

YOUR SSKC BANK

What is UPI in banking?

Unified Payments Interface (UPI) is a system that powers multiple bank accounts into a single mobile

application (of any participating bank), merging several banking features, seamless fund routing &

merchant payments into one hood.

Is UPI free?

Yes, UPI has enabled the users to send/receive money upto 1 Lakh per day instantly in real-time

basis by using a Virtual Payment Address and a UPI PIN. It is one of the most popular payment

systems in digital India for many reasons, one of which is that it is free of cost